#50 Daily Financial News Round Up - Dec 20,2021

Market Snapshot

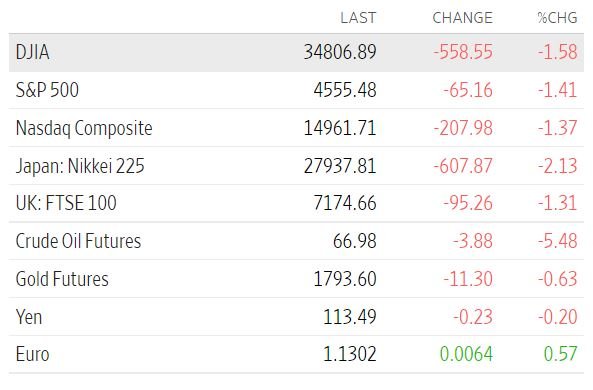

Dow Jones is down by 1.58%, S&P500 is down by 1.41%, and Nasdaq Composite is down by 1.37%.

How’s crypto-market?

Bitcoin is down by 2.52% in the last 24 hours to the price $46,085.33. XRP, Terra and Solana are the top three traded cryptocurrencies in the last 24 hours. The top 3 gainers are Yearn Finance, Bitcoin Gold and Monero. The top 3 losers are Curve DAO Token, Waves and Compound.

What news caught my attention?

Elon Musk, whose net worth is around 243 billion dollars, disclosed on Twitter that he would be paying over 11 billion dollars in taxes this year.

Senators owning cryptocurrency are working on designing the cryptocurrency regulation. This situation brings in a discussion if the senators have any conflict of interest. Owning a new piece of technology provides them with a perspective about the potential downfalls they might need to protect consumers from. On the other hand, owning an asset would distort the incentives to maximize returns made possible by holding that asset. A well-designed solution to alleviate this concern currently in practice is to disclose assets and hold themselves accountable for public scrutiny.

A new study by MIT Finance professors shows that the bitcoin network is highly concentrated in contrast to the decentralized system it was envisioned to be. A comparative analysis of crypto wealth with dollar wealth shows that bitcoin wealth is more concentrated than actual dollar wealth. For instance, in the US, which is notoriously known for the high wealth-income disparity, the top 1% of households hold about one-third of all wealth. In the bitcoin system, less than 0.01% of bitcoin holders control around 27% of the currency in circulation.

My Questions/Take-aways:

The incentive structure in the decentralized network seems aligned with the incentive structure in the capitalistic system. Similar incentive structures create an identical concentration of wealth despite different design environments.

Can people work on regulations if they own the assets in question before working on the regulation? Would disclosure be sufficient to resolve the conflict of interest? Or should they sell before working on the regulation?

How should the optimal tax structure be? Should people who create wealth be taxed at the same rate as people who earn income from the wealth creators?